Florida’s construction lien laws, governed by Chapter 713, Florida Statutes, provide contractors, subcontractors, and material suppliers with legal protection to ensure payment for their work. However, these rights must be exercised in good faith. If a lien is willfully exaggerated or fraudulent, severe penalties may apply under Florida Statutes § 713.31.

What Constitutes a Fraudulent Lien?...

Real Estate

Online reviews are a cornerstone of consumer decision-making. For businesses, a single negative review—especially when fake or malicious—can tarnish their reputation and deter potential customers. Fake anonymous reviews posted on platforms like Google are particularly harmful because they often shield the reviewer’s identity, making it difficult for businesses to address or rectify the issue. Fortunately, both Illinois and Florida courts provide mechanisms to combat these challenges, identify anonymous reviewers and initiate a legal action.

Litigation

When drafting a contract, it's essential to go beyond boilerplate clauses and envision potential scenarios that could arise, kind of like trying to acquire crystal ball powers looking into the future. We proactively engage with the client to understand the nuances of the client’s business, which in turn helps us develop a better crystal ball to protect business interests and prevent costly disputes.

Business

Tax and Other Advantages of Removing Real Property From a Revocable Living Trust and Transferring It Into a Lady Bird Deed (Florida only).

Real Estate

Building your dream home should be an exciting experience, not a stressful battle with your contractor. Unfortunately, construction projects go awry. By taking proactive steps before you even sign a contract, you can significantly reduce the risk of construction chaos. We help homeowners navigate the legal aspects of construction projects, helping with a successful journey and minimize financial nightmare, if chaos arises.

Real Estate

Real estate market is booming, and international investors are joining the wave. But before you celebrate a successful sale, there's an important tax hurdle to be aware of: the Foreign Investment in Real Property Tax Act (FIRPTA).

International Business

Florida's real estate market is a hotbed of opportunity, attracting not just sun-seekers, but also savvy foreign investors. However, when it comes time to sell your Florida property, a hurdle awaits: the Foreign Investment in Real Property Tax Act (FIRPTA).

Real Estate

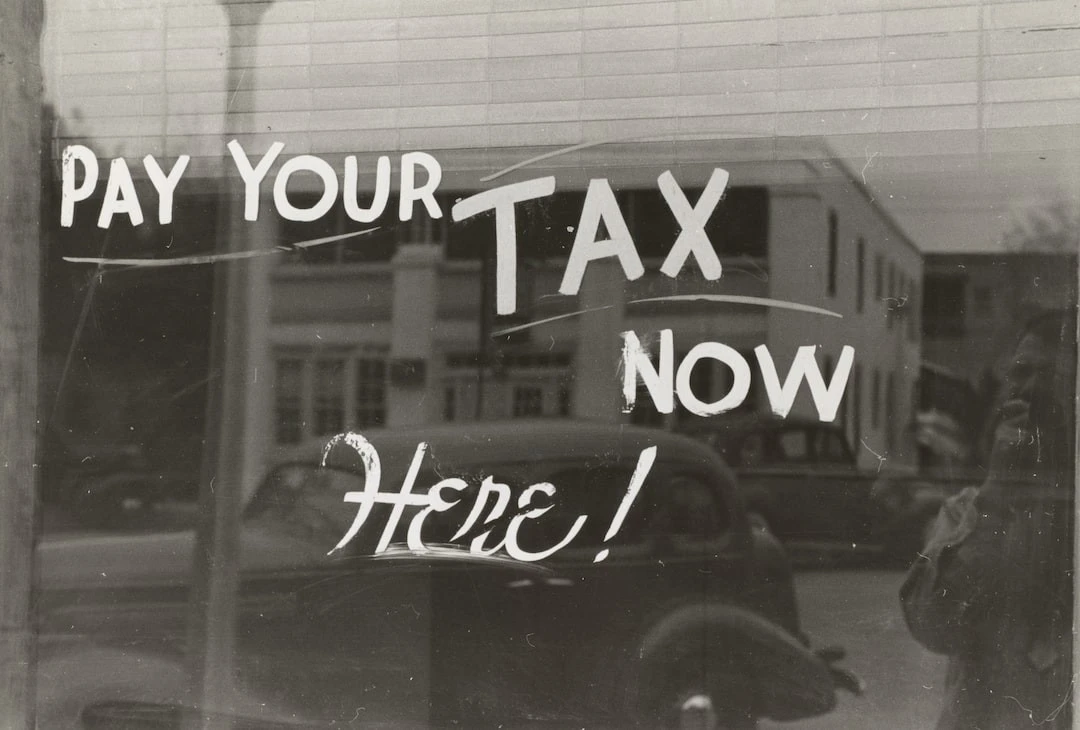

Only legal expenses directly related to the business are eligible for tax deductions, excluding fees incurred by individuals such as owners or employees. Legal fees are considered business operating expenses and can be deducted. Sole proprietors are required to report these fees on IRS Schedule C, while landlords are required to report them on Schedule E.

Business

Lawyers will save you tens of thousands of dollars in agent commissions alone, and you’ll get an attorney to answer your most pressing questions. The National Association of Realtors' own 2015 report says, "The real estate industry is saddled with a large number of part-time, untrained, unethical, and/or incompetent agents." And as one lawyer said: “Do you have an internet connection? Do you have at least a seventh-grade reading level? Do you like saving money? If you answer yes to all three, you're in fantastic shape to be your own agent.”

Real Estate

Yes. Some states do not ask for identity of business owners or members of LLCs at the time of business registration. However, effective January 1, 2024, identities of owners of private companies will have to be reported to the federal government...

Business